Personal Loan for Education Expenses

Quality education is the key to a successful future! However, the specialized courses offered by leading universities can burn a hole in your pocket.

Features and Benefits of Freo Personal Loan as a Personal Education Loan

Instant approval in real-time on a credit line of up to ₹ 5 Lakh.

Choose to withdraw as little as ₹ 3,000 or as high as your approved limit depending on your financial needs.

Pay interest only on the amount you use and not on the amount approved.

Withdraw 100% cash or rack up reward points by using your Freo credit card.

Repay in flexible EMIs while choosing a convenient payment period anywhere in between 2 to 36 months.

You are only required to submit your proof of address and proof of identity to get started.

Eligibility Criteria

Must be a full-time salaried employee with a minimum take-home salary of ₹30,000/month

or

Must be a self-employed professional with an income of at least ₹30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)

Must be above 23 years and below 55 years of age

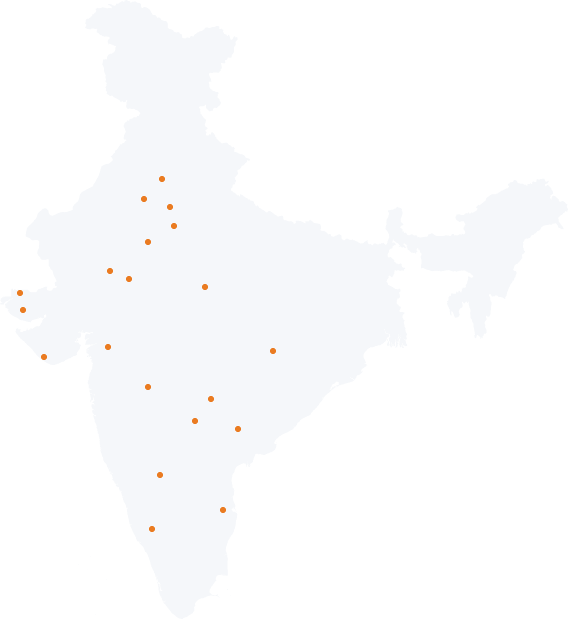

Must be a resident of one of the following cities:

Required Documents

Pan Card Number

Professional Selfie

To be taken on the Freo App

Address Proof

Valid Driving License / Valid Passport / Aadhar Card

ID Proof

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

Reasons Why You’re Here

Come from a middle-class family and want to fund your child’s education

Pay your child’s fees without any last-minute hassles

Fund your child’s education abroad

Pay your child’s college fees and other additional expenses

Need financial aid to meet the expenses related to your child’s education, such as tuition fees, living expenses, books, uniforms

Upgrade your job skills with an advanced course

Want to pursue advanced degrees or higher education at colleges across the country

Want to pay off a student loan debt

Tips to Use a Personal Education Loan Responsibly

If borrowing for higher education, look at your career options wisely and the possibilities you may have after your course is complete, and judge if you would be able to get a job to pay off the loan.

Calculate your budget and the loan amount you require at a given period of time.

For parents, who haven’t saved enough for their kids’ education, plan for the repayment of the loan with EMIs that do not disturb your monthly expenses.