Home Renovation Loan

Is your house in dire need of a renovation? Or maybe it needs a simple flip and fixes to increase its renting value? What will you do in such a situation?

Freo Personal Loan for Home Renovation Features and Benefits

Receive real-time approval on a credit line of up to ₹ 5 Lakh.

Withdraw as little as ₹ 3,000 or as high as your approved limit, the choice is yours to make.

Pay interest only on the amount you withdraw and not on the entire amount allocated to you.

Freo credit card lets you enjoy 100% cash withdrawal as well as special rewards.

Repay in flexible EMIs by choosing a payment period that works for you which could be anywhere between 2 months to 36 months.

Your proof of address and ID proof are the only two documents we need to begin with.

Eligibility Criteria

Must be a full-time salaried employee with a minimum take-home salary of ₹30,000/month

or

Must be a self-employed professional with an income of at least ₹30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)

Must be above 23 years and below 55 years of age

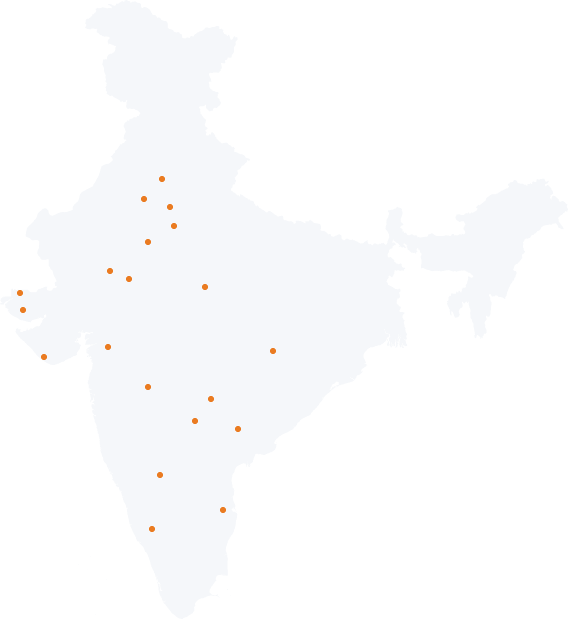

Must be a resident of one of the following cities:

Required Documents

Pan Card Number

Professional Selfie

To be taken on the Freo App

Address Proof

Valid Driving License / Valid Passport / Aadhar Card

ID Proof

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

Reasons You Are Here

Want to renovate your home but strapped for cash

Upgrade your existing home to a contemporary design

Furnish your new home and pay for fittings, furniture, etc.

Pay for your rent or down-payment

Want to get internal and external repairs

Want to expand your home

Need kitchen remodelling or fixing

Increase the resale value of your home with minor repairs

When to Consider a Personal Home Remodelling Loan?

You don’t have enough home equity to borrow against

You need a one-time loan for a smaller, single home improvement project

For minor or major renovations

You want to be able to budget for the same loan payments each month

You don’t want to utilize your existing savings on a home restoration project