Digital Savings Account

Digital Savings Account

What is a Digital Savings Account?

What is a Digital Savings Account?

A digital savings account works like any traditional account in its function but is way more convenient. The convenience comes from the fact that a digital savings account can be accessed anytime from your phone or laptop no matter where you are – you don’t need to make trips to a physical branch location.

With just a few clicks, you can open a digital savings account online, make deposits, carry out transactions by accessing your funds, pay bills, and manage your expenses.

A digital savings account works like any traditional account in its function but is way more convenient. The convenience comes from the fact that a digital savings account can be accessed anytime from your phone or laptop no matter where you are – you don’t need to make trips to a physical branch location.

With just a few clicks, you can open a digital savings account online, make deposits, carry out transactions by accessing your funds, pay bills, and manage your expenses.

Freo Save’s Zero Balance Digital Savings Account

Freo Save’s Zero Balance Digital Savings Account

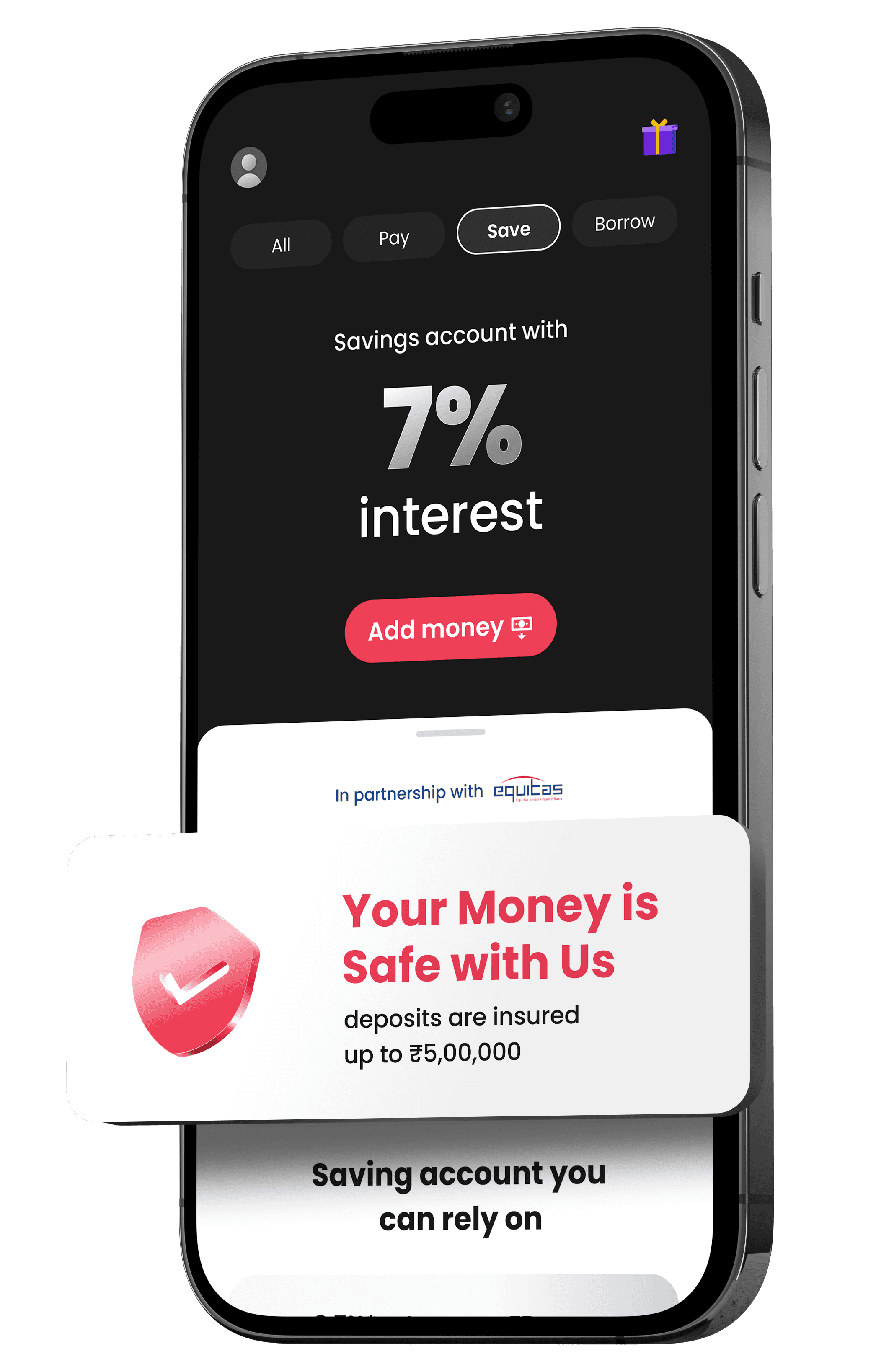

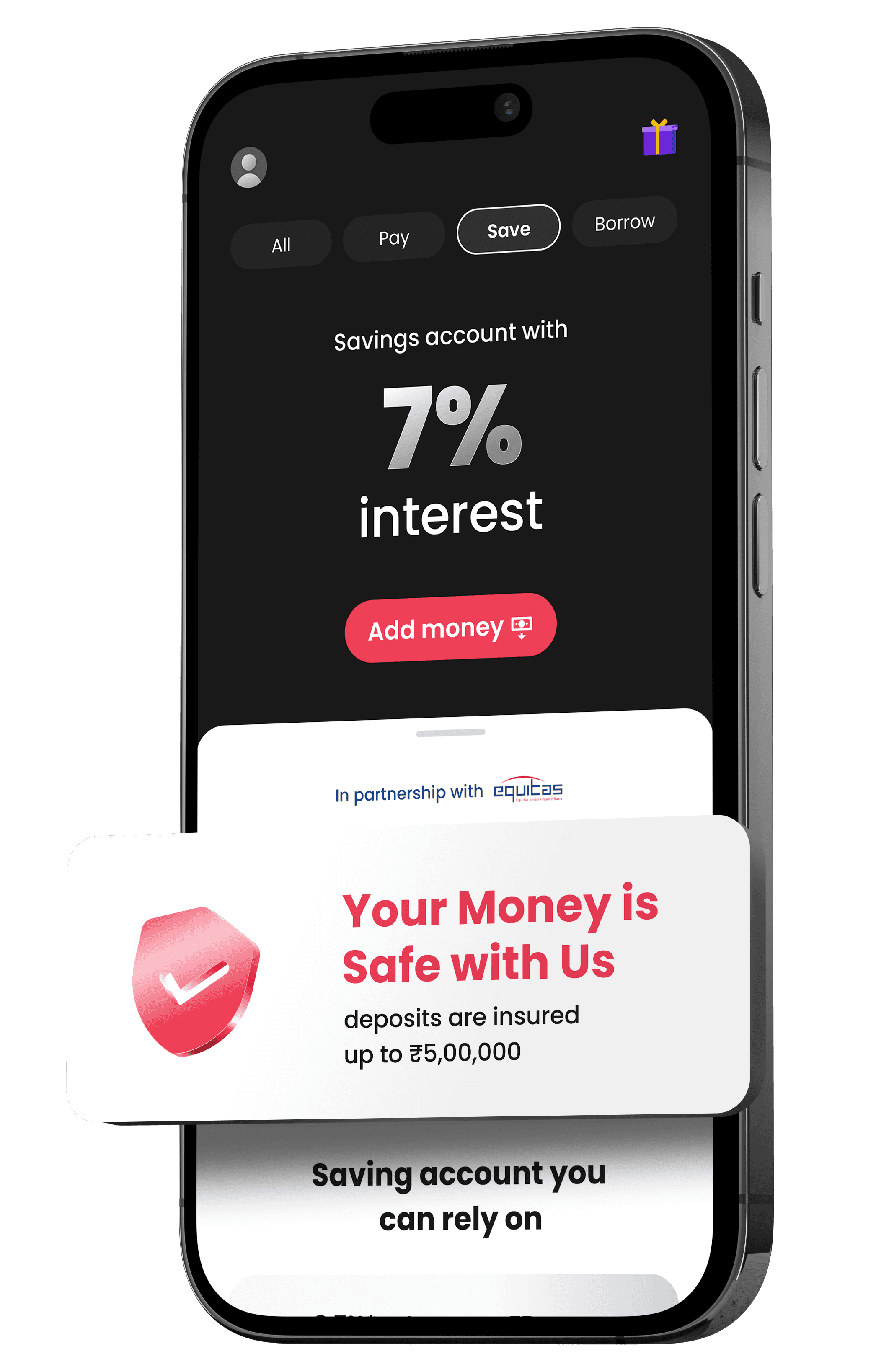

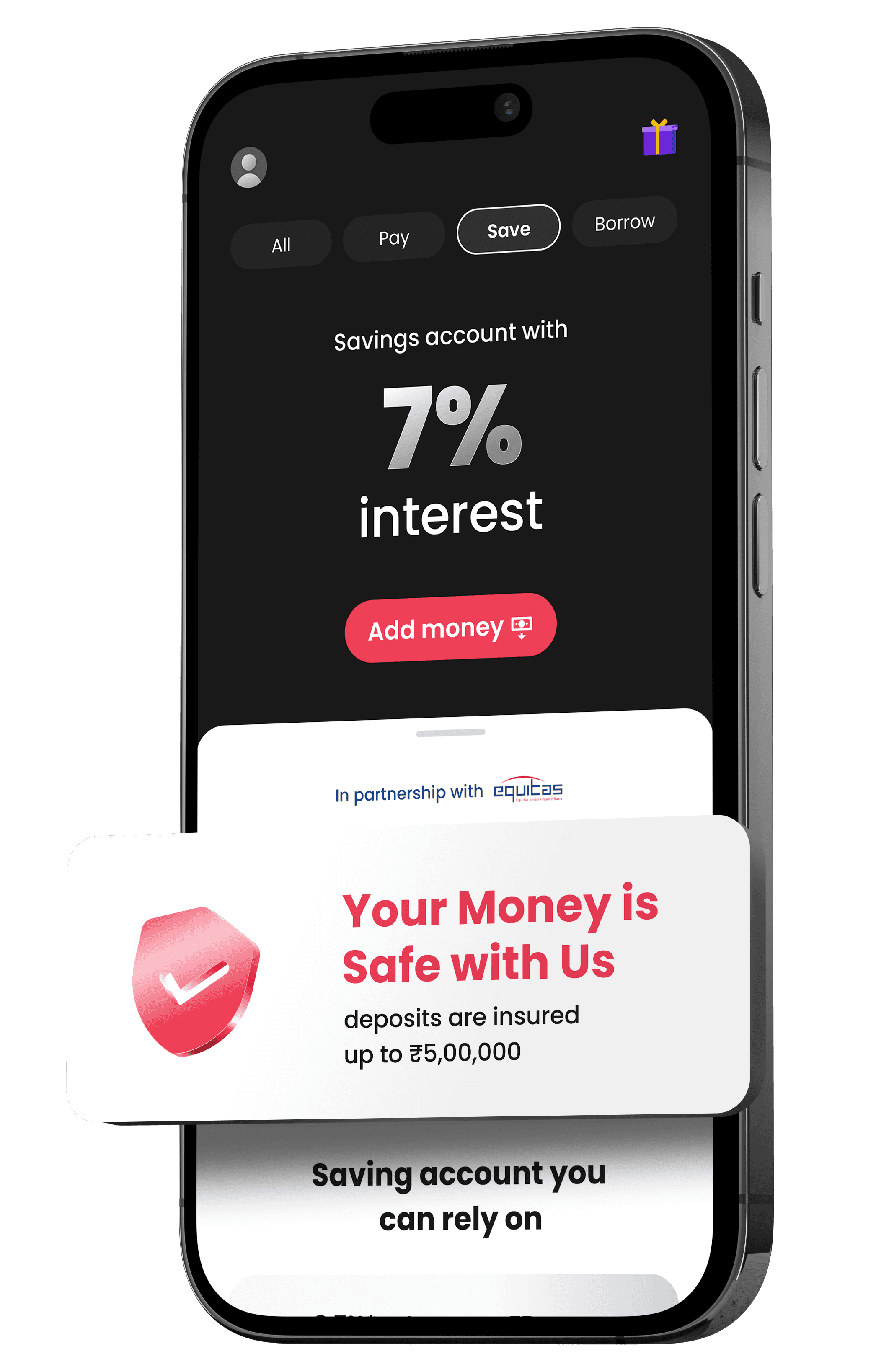

Freo Save’s rewarding zero-balance savings account offers an entirely digital experience! Open a savings account, and you will have several benefits at your fingertips.

With Freo Save, you can earn up to 7% interest on your savings, among the highest rates you can get in the market today. And you don’t have to worry about paying a maintenance fee – even if you don’t have funds in your account and your balance is zero.

Besides the standard savings account function, several other features make Freo Save’s digital savings account a great option.

What are the Features of Freo Save? A Complete Digital Experience

Besides offering higher interest rates, the added features you can benefit from by opening a Freo Save account are amazing. Take a look:

100% Digital

Digitalized banking experience allows you to open an account within minutes – no need for paperwork!

100% Digital

Digitalized banking experience allows you to open an account within minutes – no need for paperwork!

100% Digital

Digitalized banking experience allows you to open an account within minutes – no need for paperwork!

Higher Interest Rates

You can earn up to 7% interest on your savings, making it an excellent option for everyone.

Higher Interest Rates

You can earn up to 7% interest on your savings, making it an excellent option for everyone.

Higher Interest Rates

You can earn up to 7% interest on your savings, making it an excellent option for everyone.

Zero Balance Savings Account

No more maintenance charges. Spend from your savings account without worrying about getting penalized for not keeping a minimum balance in your account! Check out our guide Which Bank Is Best For Zero Balance Account? to explore the best options!

Zero Balance Savings Account

No more maintenance charges. Spend from your savings account without worrying about getting penalized for not keeping a minimum balance in your account! Check out our guide Which Bank Is Best For Zero Balance Account? to explore the best options!

Zero Balance Savings Account

No more maintenance charges. Spend from your savings account without worrying about getting penalized for not keeping a minimum balance in your account! Check out our guide Which Bank Is Best For Zero Balance Account? to explore the best options!

Available in Varnacular

You can access your account in several languages as Freo Save is available in Hindi, Tamil, Kannada, Telugu, Malayalam, Bengali, Marathi, and more!

Available in Varnacular

You can access your account in several languages as Freo Save is available in Hindi, Tamil, Kannada, Telugu, Malayalam, Bengali, Marathi, and more!

Available in Varnacular

You can access your account in several languages as Freo Save is available in Hindi, Tamil, Kannada, Telugu, Malayalam, Bengali, Marathi, and more!

Virctual Debit Card

With the virtual debit card, you can shop online, claim cashback, stay protected against card frauds, and reset your card PIN through the savings app! Physical card coming soon.

Virctual Debit Card

With the virtual debit card, you can shop online, claim cashback, stay protected against card frauds, and reset your card PIN through the savings app! Physical card coming soon.

Virctual Debit Card

With the virtual debit card, you can shop online, claim cashback, stay protected against card frauds, and reset your card PIN through the savings app! Physical card coming soon.

₹5 Lakh Deposit Insurance

Your money in the account is insured up to ₹5 Lakh as per the RBI mandate.

₹5 Lakh Deposit Insurance

Your money in the account is insured up to ₹5 Lakh as per the RBI mandate.

₹5 Lakh Deposit Insurance

Your money in the account is insured up to ₹5 Lakh as per the RBI mandate.

Complete Security

Built on the Equitas SFB’s secure banking platform, your financial data is safe with full security controls on our app!

Complete Security

Built on the Equitas SFB’s secure banking platform, your financial data is safe with full security controls on our app!

Complete Security

Built on the Equitas SFB’s secure banking platform, your financial data is safe with full security controls on our app!

Pay Later

Shop Instantly, Pay at your Pace 30 days Interest-free Repay. Reuse

Pay Later

Shop Instantly, Pay at your Pace 30 days Interest-free Repay. Reuse

Pay Later

Shop Instantly, Pay at your Pace 30 days Interest-free Repay. Reuse

Borrow

Flexible Credit Instant Transfer No Usage, No Interest Choose Easy EMIs

Borrow

Flexible Credit Instant Transfer No Usage, No Interest Choose Easy EMIs

Borrow

Flexible Credit Instant Transfer No Usage, No Interest Choose Easy EMIs

Boxes (Coming Soon)

A unique feature that will help you invest, save, have access to credit or unlock gifts and seasonal rewards!

Boxes (Coming Soon)

A unique feature that will help you invest, save, have access to credit or unlock gifts and seasonal rewards!

Boxes (Coming Soon)

A unique feature that will help you invest, save, have access to credit or unlock gifts and seasonal rewards!

Wealth Products (Coming Soon)

You can enjoy all Freo Save benefits with Regular Tier, begin your savings young with Junior Tier and unlock rewards of higher value with Premium Tier!

Wealth Products (Coming Soon)

You can enjoy all Freo Save benefits with Regular Tier, begin your savings young with Junior Tier and unlock rewards of higher value with Premium Tier!

Wealth Products (Coming Soon)

You can enjoy all Freo Save benefits with Regular Tier, begin your savings young with Junior Tier and unlock rewards of higher value with Premium Tier!

Multiple Tier of Additional Rewards (Coming Soon)

Grow your wealth faster with Recurring Deposits, Fixed Deposits and more!

Multiple Tier of Additional Rewards (Coming Soon)

Grow your wealth faster with Recurring Deposits, Fixed Deposits and more!

Multiple Tier of Additional Rewards (Coming Soon)

Grow your wealth faster with Recurring Deposits, Fixed Deposits and more!

How to Open a Zero Balance Digital Savings Account with Freo Save?

Opening an online bank account with us is simple! All you have to do is follow these five easy steps, and you are all set to go!

1

Download the Freo Save App

Our app is available both on Android and iOS. Download it from your Google Playstore or App Store to begin your zero-balance savings account journey!

Download the App and Open Your Digital Savings Account!

A savings plan can help you manage your family’s finances better and prevent unforeseen expenses. If you have a savings plan, you will know how much money is available for emergencies or unexpected costs. This will also help you plan for the future and invest wisely for your retirement.

2

PAN and Aadhaar Verification

Once the app is downloaded, we ask you to verify your PAN and Aadhaar card. Just fill in your Aadhaar and PAN card number, and our systems will fetch your information to verify it’s you.

Once the app is downloaded, we ask you to verify your PAN and Aadhaar card. Just fill in your Aadhaar and PAN card number, and our systems will fetch your information to verify it’s you.

A savings plan can help you manage your family’s finances better and prevent unforeseen expenses. If you have a savings plan, you will know how much money is available for emergencies or unexpected costs. This will also help you plan for the future and invest wisely for your retirement.

3

Provide Personal and Professional Details

Once you download our app, you will be asked to provide and verify your email id and mobile number. Next, you will need to answer four basic questions related to your personal and professional details.

Once you download our app, you will be asked to provide and verify your email id and mobile number. Next, you will need to answer four basic questions related to your personal and professional details.

A savings plan can help you manage your family’s finances better and prevent unforeseen expenses. If you have a savings plan, you will know how much money is available for emergencies or unexpected costs. This will also help you plan for the future and invest wisely for your retirement.

4

Match Selfie and Confirm Address

In this step, you will be asked to take a selfie and upload it to match the live image with the Aadhaar card image. This makes the account opening process more secure. Furthermore, we will ask you to verify your location details.

In this step, you will be asked to take a selfie and upload it to match the live image with the Aadhaar card image. This makes the account opening process more secure. Furthermore, we will ask you to verify your location details.

A savings plan can help you manage your family’s finances better and prevent unforeseen expenses. If you have a savings plan, you will know how much money is available for emergencies or unexpected costs. This will also help you plan for the future and invest wisely for your retirement.

5

Add Nominee

Finally, you will be asked to add a nominee. Once you add a nominee to your Freo Save savings account, you are all set to start!

Finally, you will be asked to add a nominee. Once you add a nominee to your Freo Save savings account, you are all set to start!

A savings plan can help you manage your family’s finances better and prevent unforeseen expenses. If you have a savings plan, you will know how much money is available for emergencies or unexpected costs. This will also help you plan for the future and invest wisely for your retirement.

FAQ

Which Is the Best Digital Savings Account in India?

What Is the Minimum Balance Requirement for Freo's Digital Savings Account?

What Are the Interest Rates for Freo’s Digital Savings Account?

Are Digital Banks Safe?

Which Is the Best Digital Savings Account in India?

What Is the Minimum Balance Requirement for Freo's Digital Savings Account?

What Are the Interest Rates for Freo’s Digital Savings Account?

Are Digital Banks Safe?

Which Is the Best Digital Savings Account in India?

What Is the Minimum Balance Requirement for Freo's Digital Savings Account?

What Are the Interest Rates for Freo’s Digital Savings Account?

Are Digital Banks Safe?

Open Your Freo Save Digital Savings Account Now!

Open Your Freo Save Digital Savings Account Now!

Click here

Click here

Make the Move

What are you waiting for?

Copyright © 2024 MWYN Tech Pvt Ltd. All rights reserved.

Make the Move

What are you waiting for?

Copyright © 2024 MWYN Tech Pvt Ltd. All rights reserved.

Make the Move

What are you waiting for?

Copyright © 2024 MWYN Tech Pvt Ltd. All rights reserved.